Client Consultancy Project: Innovating Trust: Designing a Secure and Seamless E-Wallet Experience

Overview

The rapid growth of digital payments and mobile banking in financial technology presents a significant market opportunity for businesses. However, as these technologies evolve, the challenge of designing secure and user-friendly e-wallets remains central to fintech innovation.

This project, part of a client consultancy engagement during my MA in User Experience Design at Regent’s University London, focused on enhancing authentication processes within a fintech application. The goal was to strike a balance between strong security and a user-friendly experience. The research insights led to the development of low-fidelity and high-fidelity prototypes for the client’s e-wallet application.

The Problem: Balancing Security& Usability

Research Methodology: Mixed Methods Research

Findings

Design Process: Linking Research to Design

Design Decisions

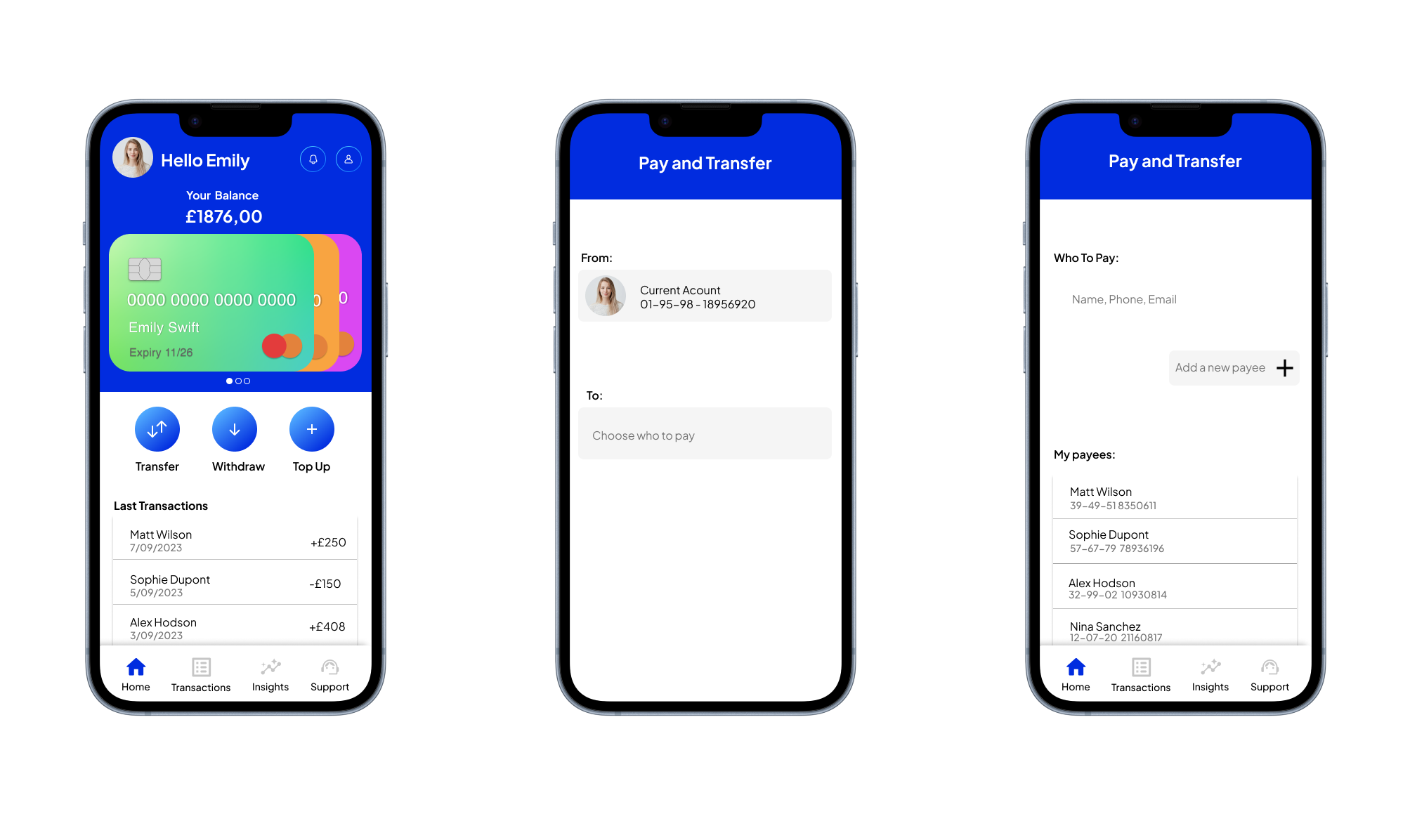

Wireframes

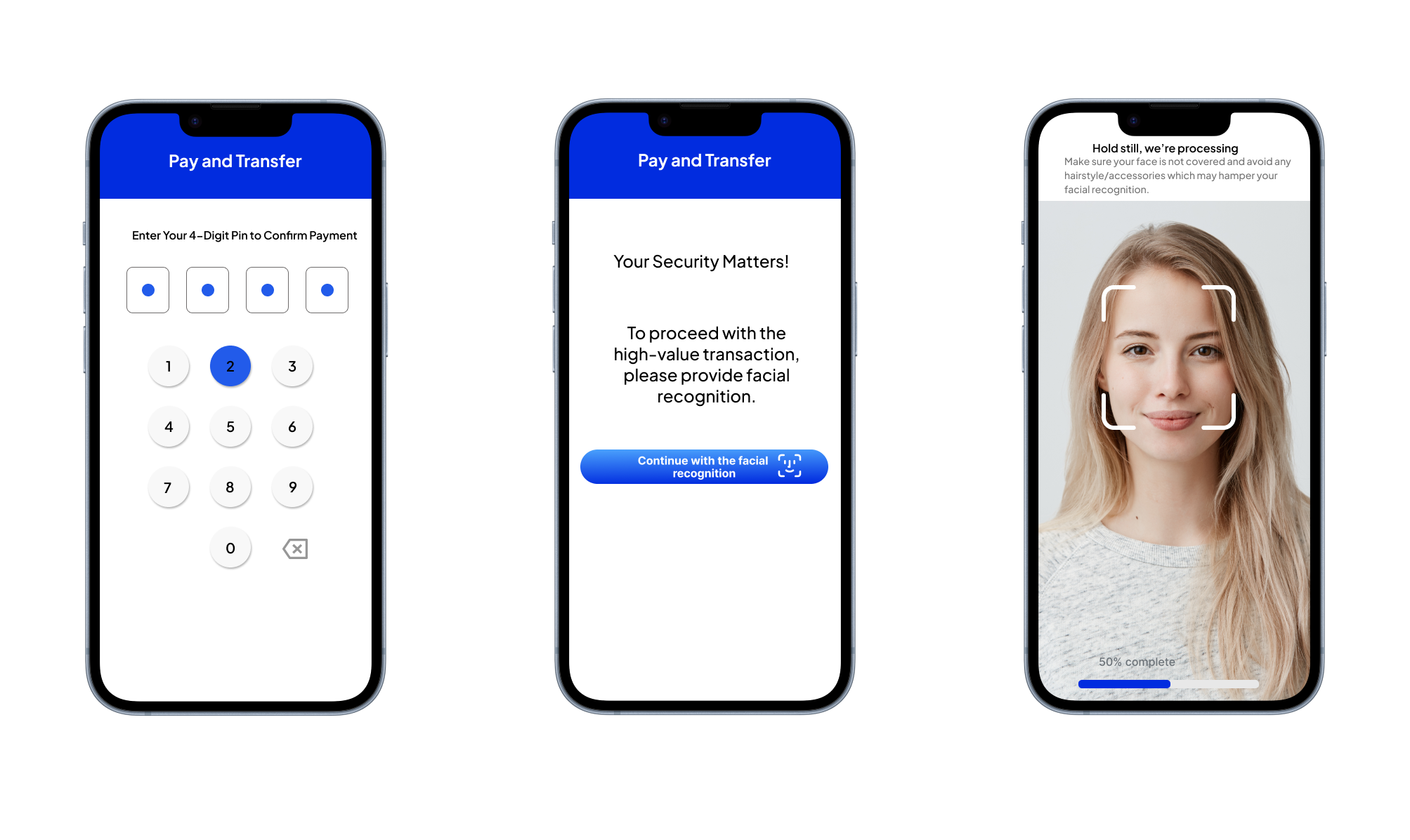

High Fidelity Prototype

Reflections and Learnings

The adoption of mobile payment applications relies heavily on perceived security and usability. While stronger security measures like multi-factor authentication enhance protection, they often complicate the interface with extra steps, leading to user frustration and higher drop-off rates. Conversely, insufficient security undermines user trust.

This project aimed to address this dilemma by analyzing user opinions on various authentication methods and their impact on security, usability, and trust in fintech applications. The main research question was:

How might we design an e-wallet application that maximises the perceived security of users’ personal and financial data, minimises user friction, and ultimately fosters high levels of trust and adoption by strategically choosing an authentication system?

Quantitative Method:Questionnaires were conducted with 27 participants who were daily users of fintech applications.

Qualitative Method: 4 structured interviews were conducted with fintech professionals, including a bank VP, UX designer, full-stack developer, and a head of legal.

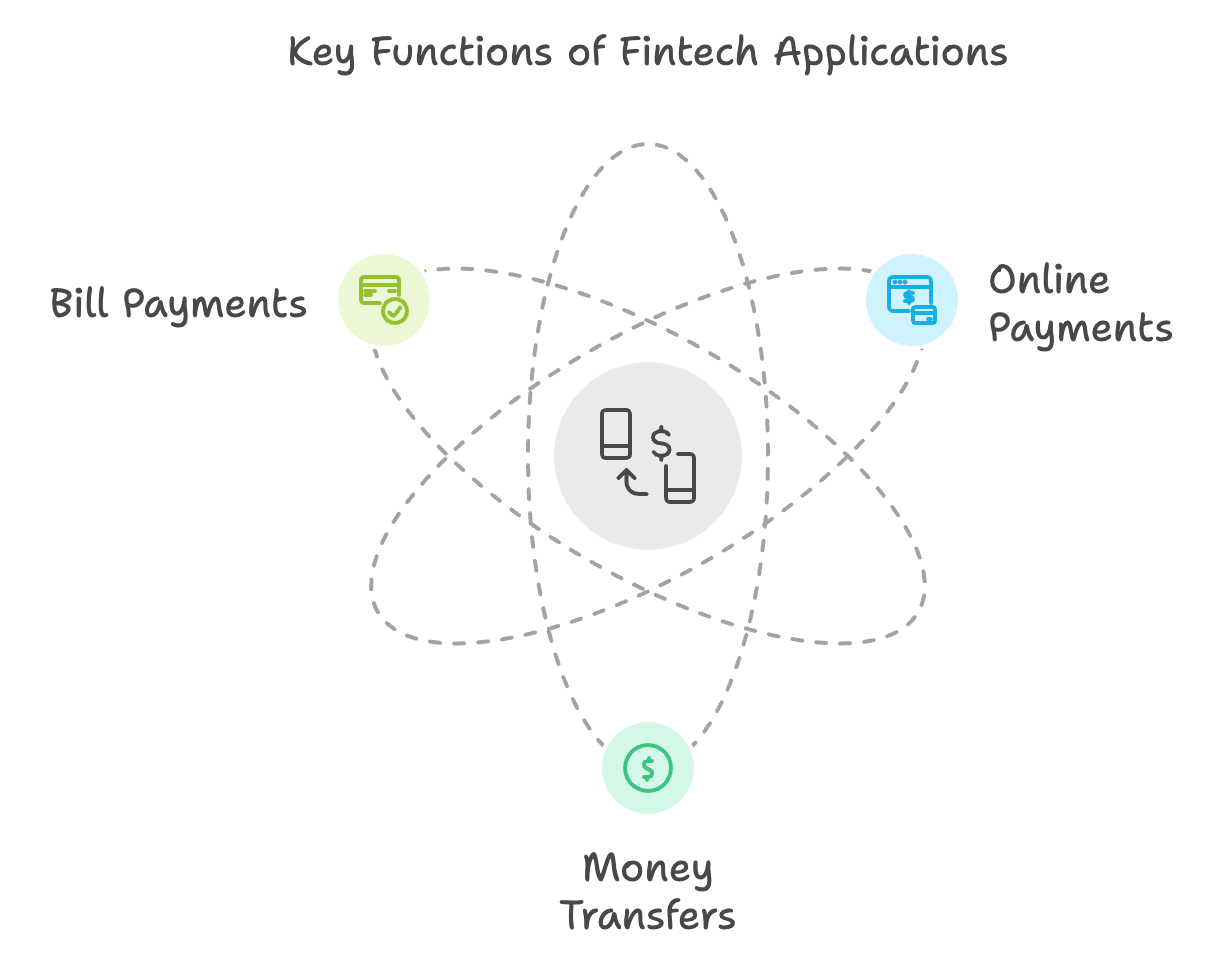

Primary Uses of Fintech Applications:

The majority of participants indicated that their primary use of fintech applications includes online payments (88.9%), money transfers (74.1%), and bill payments. This reinforced the importance of focusing on secure, seamless payment and transfer flows in the e-wallet design, which are central to the application's functionality.

Security Concerns:

Users expressed significant concern over the security of their personal and financial data.

No single security feature was universally preferred, highlighting the importance of a well-rounded security approach to address various concerns.

Biometrics (e.g., fingerprint or facial recognition) were perceived as more secure, offering a unique sense of safety due to their personal nature.

Usability Challenges:

Recurring issues with authentication methods included:

Password fatigue: Users found it hard to remember multiple passwords.

OTP and MFA inconvenience: While secure, they interrupt the flow, requiring users to leave the app.

Biometrics: Favoured for being quick, intuitive, and requiring minimal user effort.

Key Insight:

Biometric authentication emerged as the optimal balance between security and ease of use, creating trust while reducing friction for daily interactions.

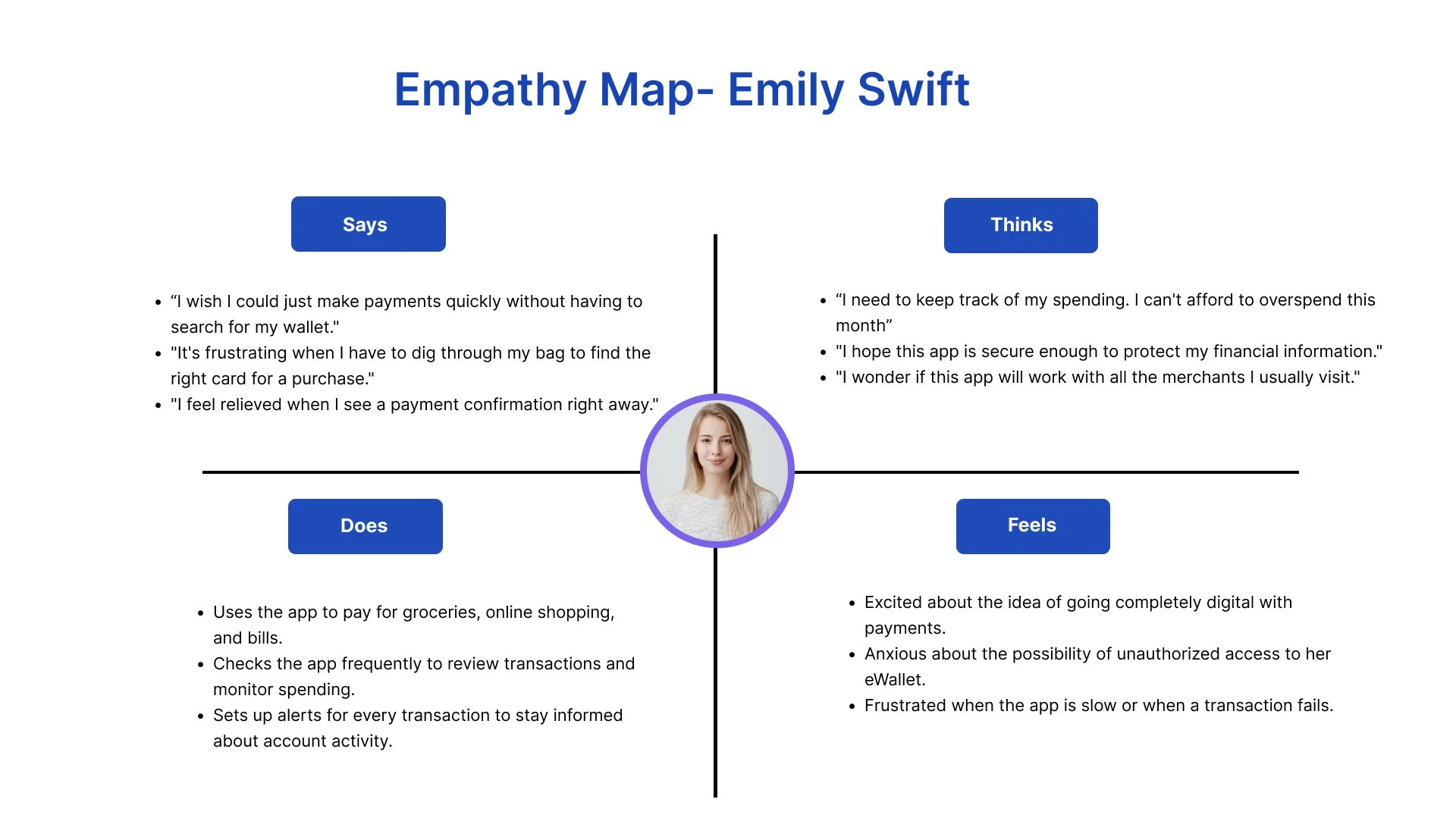

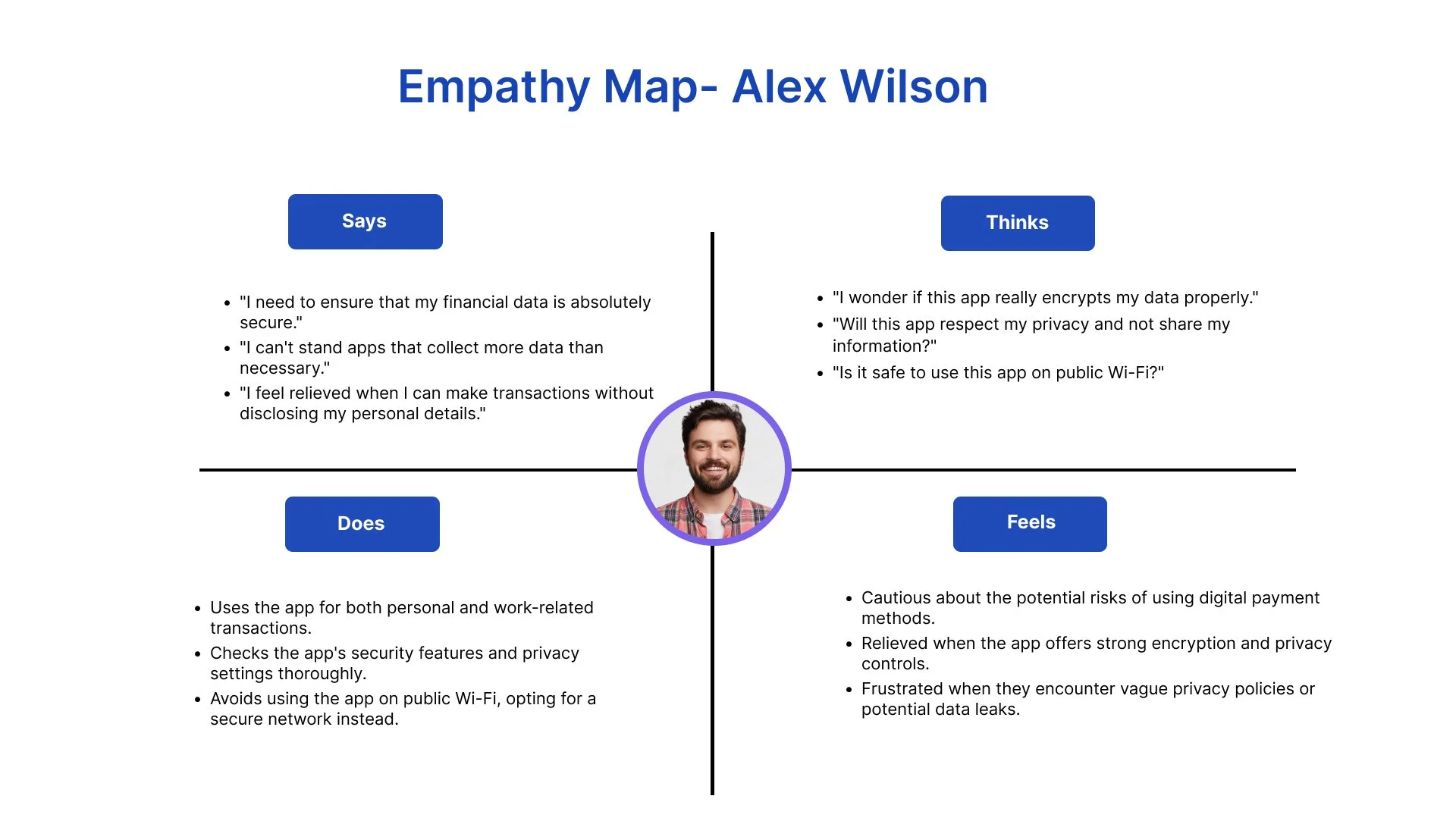

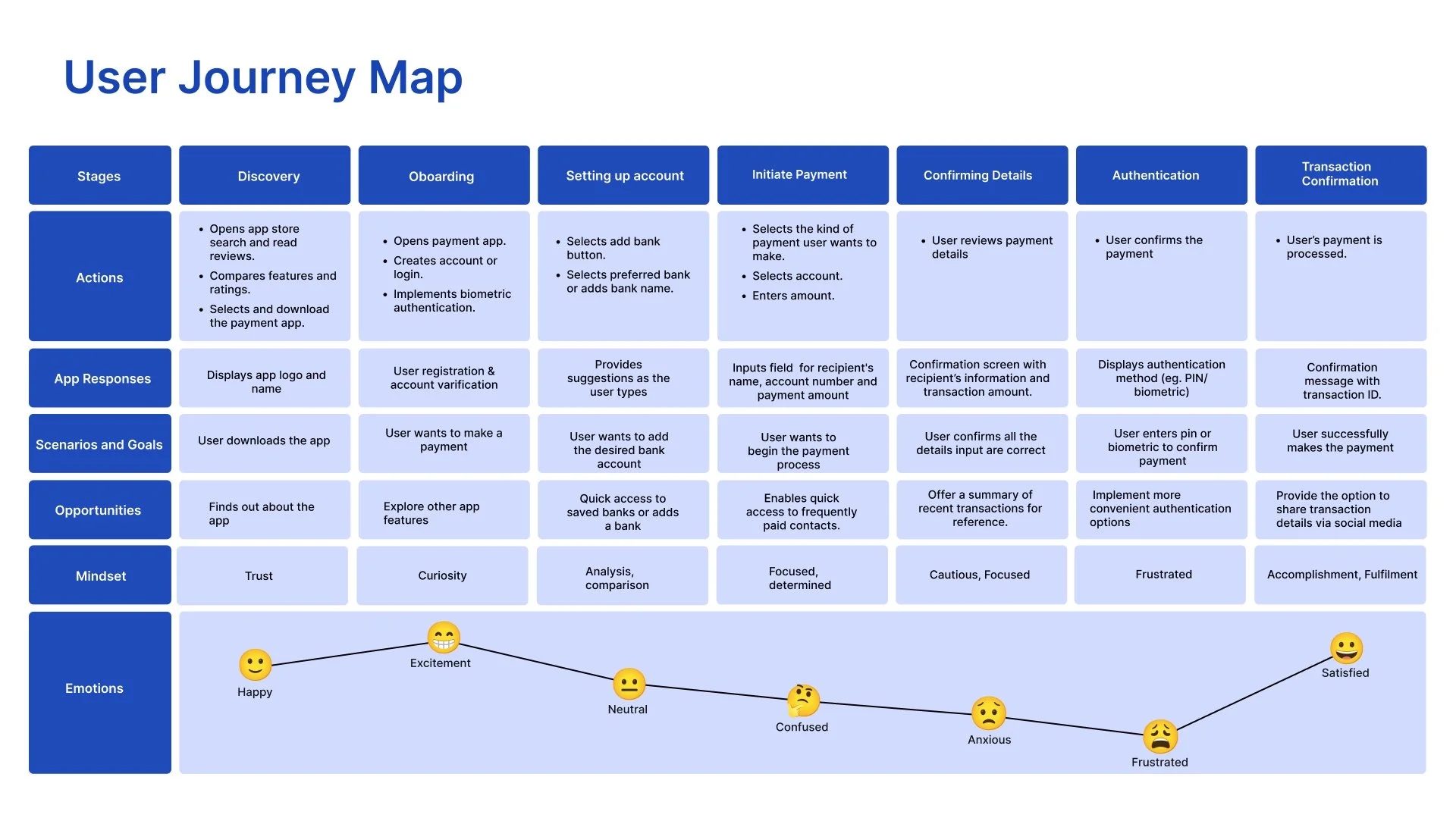

Empathy and Understanding the Users

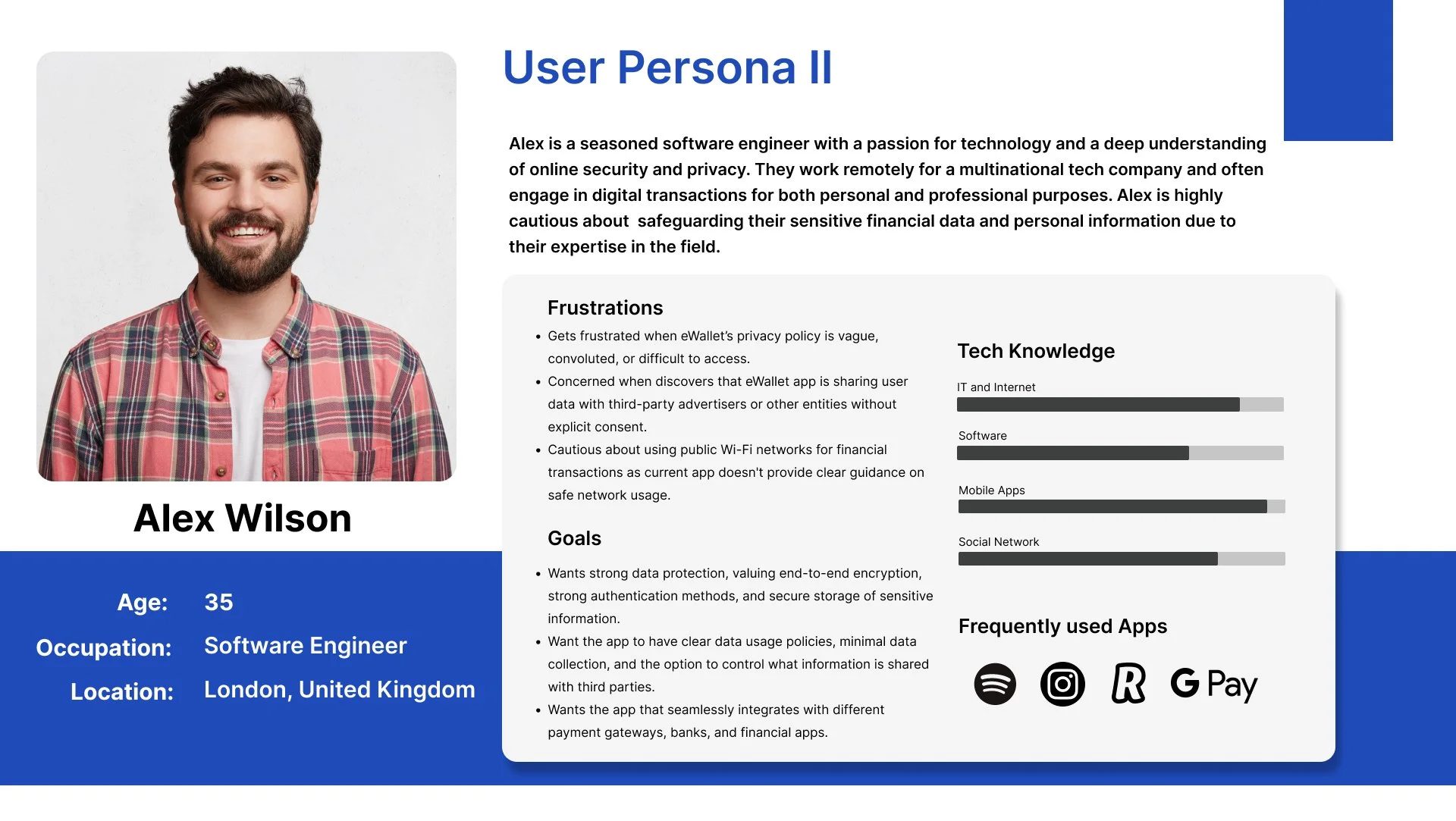

The research findings directly informed the design of the e-wallet application by addressing users' key concerns about security and usability. Two primary personas were developed based on the insights:

Emily: A busy marketing manager who values speed and simplicity for frequent, low-risk transactions.

Alex: A tech-savvy software engineer who prioritises robust security for high-risk transactions.

The personas inspired the design of two distinct authentication flows: a simplified low-risk flow for ease of use and a secure high-risk flow for sensitive actions.

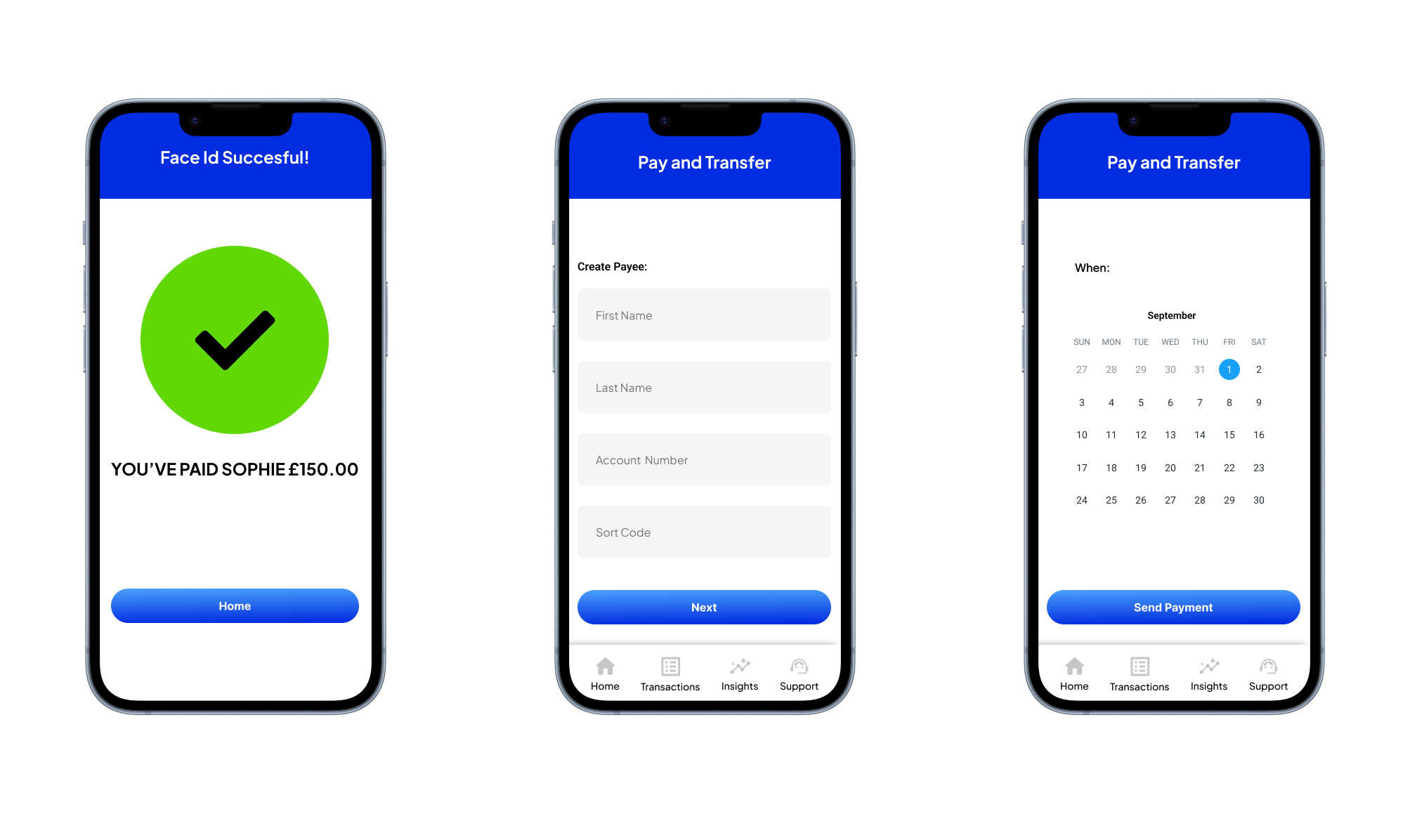

Interactive Prototype

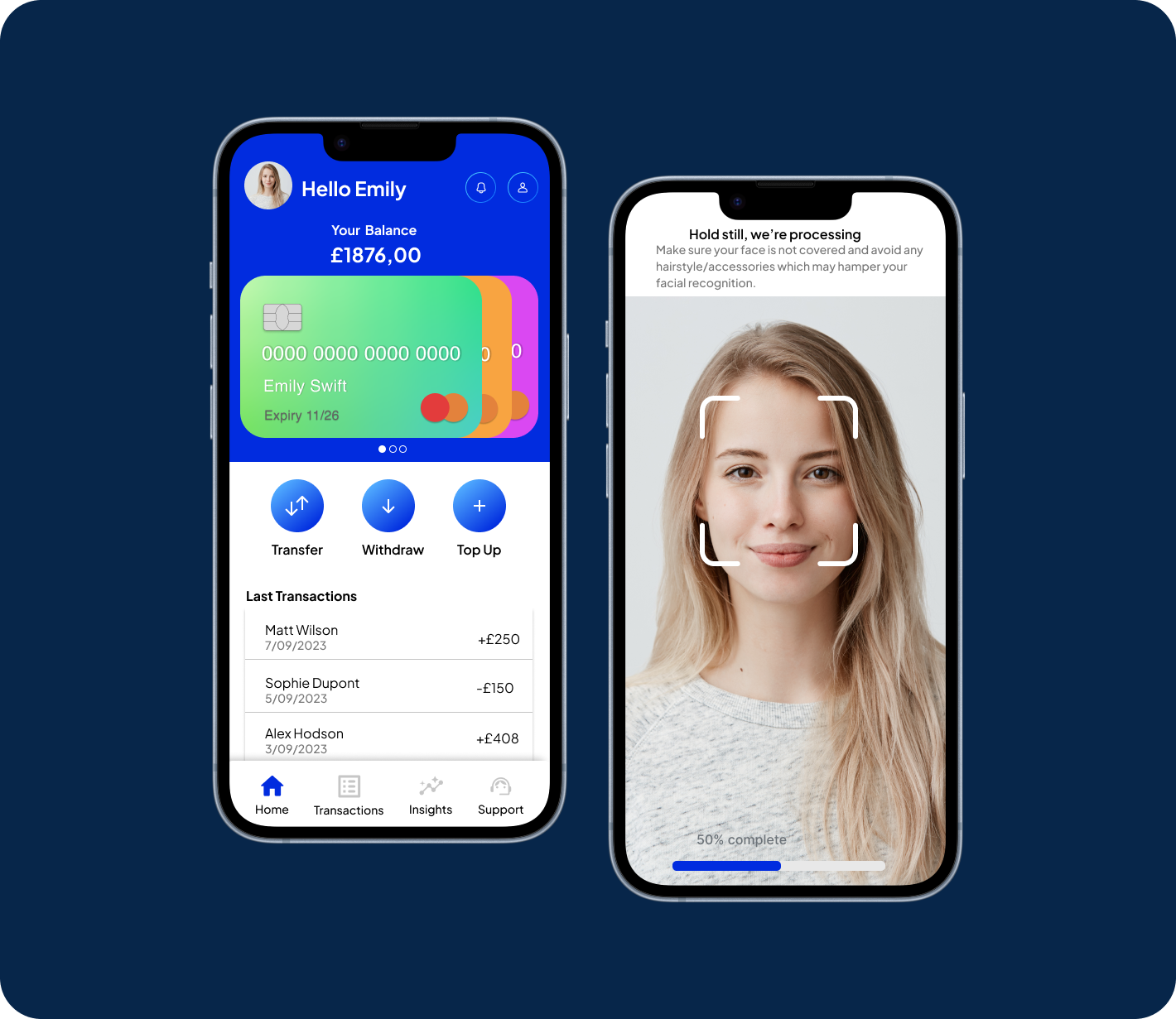

Low-Risk Transactions (For Emily)

Solution: Biometric-only authentication for a quick and seamless experience.

Flow: Transaction Details → Biometric Authentication → Confirmation

Impact: Reduced friction, ideal for frequent, small payments.

High-Risk Transactions (For Alex)

Solution: Multi-factor authentication (MFA) with a PIN and biometrics for enhanced security.

Flow: Transaction Details → PIN Authentication → Biometric Authentication → Confirmation

Impact: Increased trust and protection for sensitive transactions.

Data-Driven Decision-Making: I honed my ability to analyse qualitative and quantitative data to inform design decisions, ensuring the e-wallet met both user needs and security requirements.

Strategic Design Thinking: Balancing multiple user needs—like Emily's desire for simplicity and Alex's need for control—taught me how to strategically tailor solutions for diverse personas.

Collaboration with Cross-Functional Teams: Collaborating with stakeholders and developers enhanced my ability to communicate design intent effectively and ensure solutions aligned with technical feasibility.

End-to-End UX Process: From user research to high-fidelity prototypes, this project strengthened my ability to handle the entire UX design process, showcasing my versatility as a designer.